Both of these terms refer to the investigation of financial incidents and irregularities that can occur in businesses. However, there is some key difference between fraud examination and forensic accounting.

What is Forensic Accounting and Fraud Detection?

Fraud examination typically focuses on detecting, preventing, and investigating financial crimes. This includes examining documents for discrepancies or irregularities to uncover potential fraud and analyzing financial statements for potentially illegal activities.

In addition, fraud examiners may conduct interviews with suspects and witnesses involved in a case to gain more information about suspicious behavior or transactions. It is important to remember that fraud examination does not necessarily involve criminal prosecution; it is simply a method of investigating potential illegal activity.

Forensic accounting is similar to fraud examination in that it also involves examining documents for irregularities or discrepancies; however, its focus is on civil litigation rather than criminal prosecution. Forensic accountants analyze financial records to calculate damages or determine if there has been any misappropriation of funds or other assets. They may also provide expert testimony in court cases involving financial disputes or white-collar crime allegations.

What is Another Name for Forensic Accounting?

In addition to being known as “forensic accounting”, this field also goes by several different names. These include “fraud examination”, “investigative accounting”, and “financial forensics”. All of these terms refer to the same type of work – using one’s knowledge of auditing and investigative techniques to uncover fraud or other types of financial crime.

What Is the Difference Between Fraud Examination and Forensic Accounting?

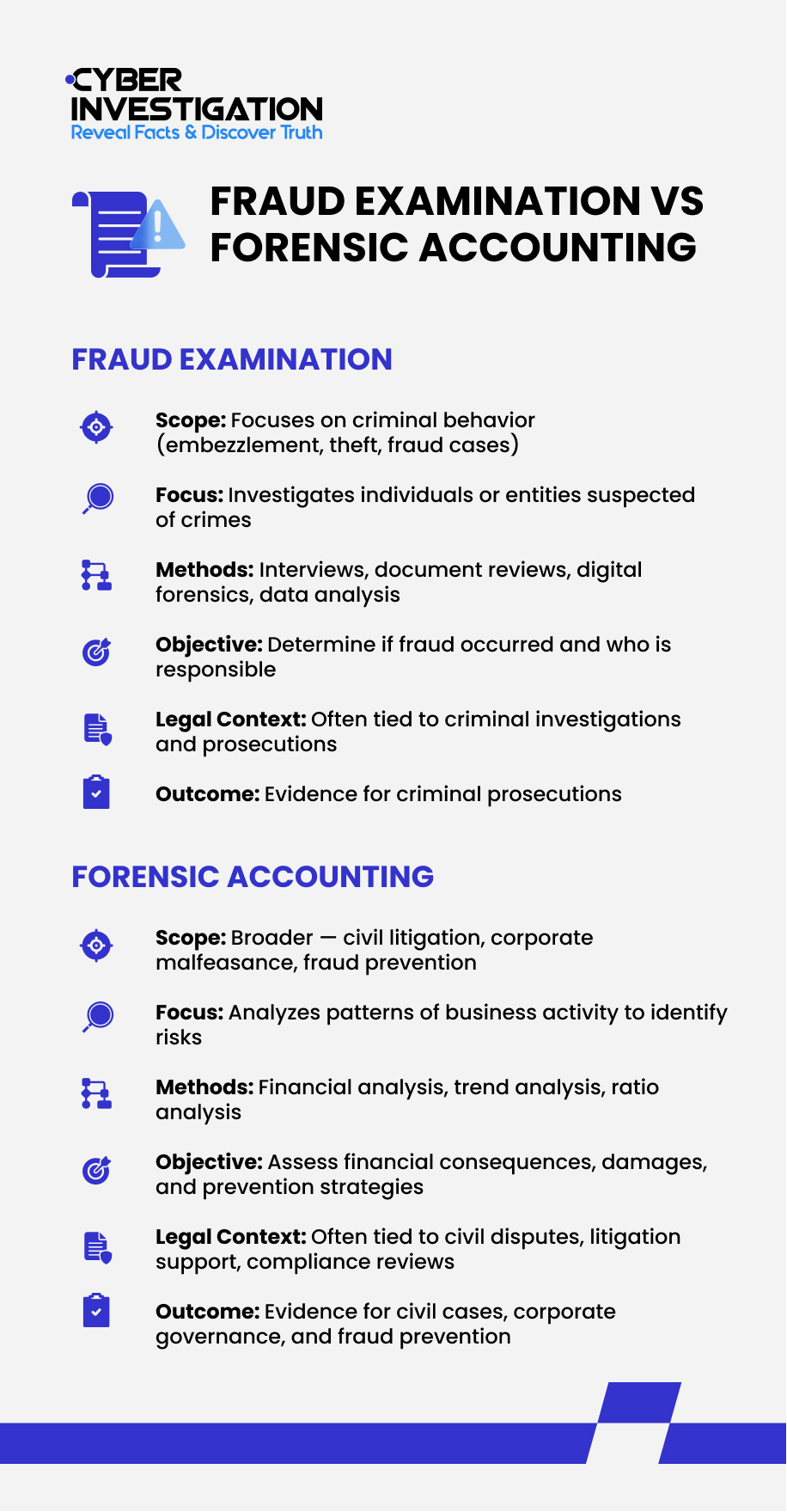

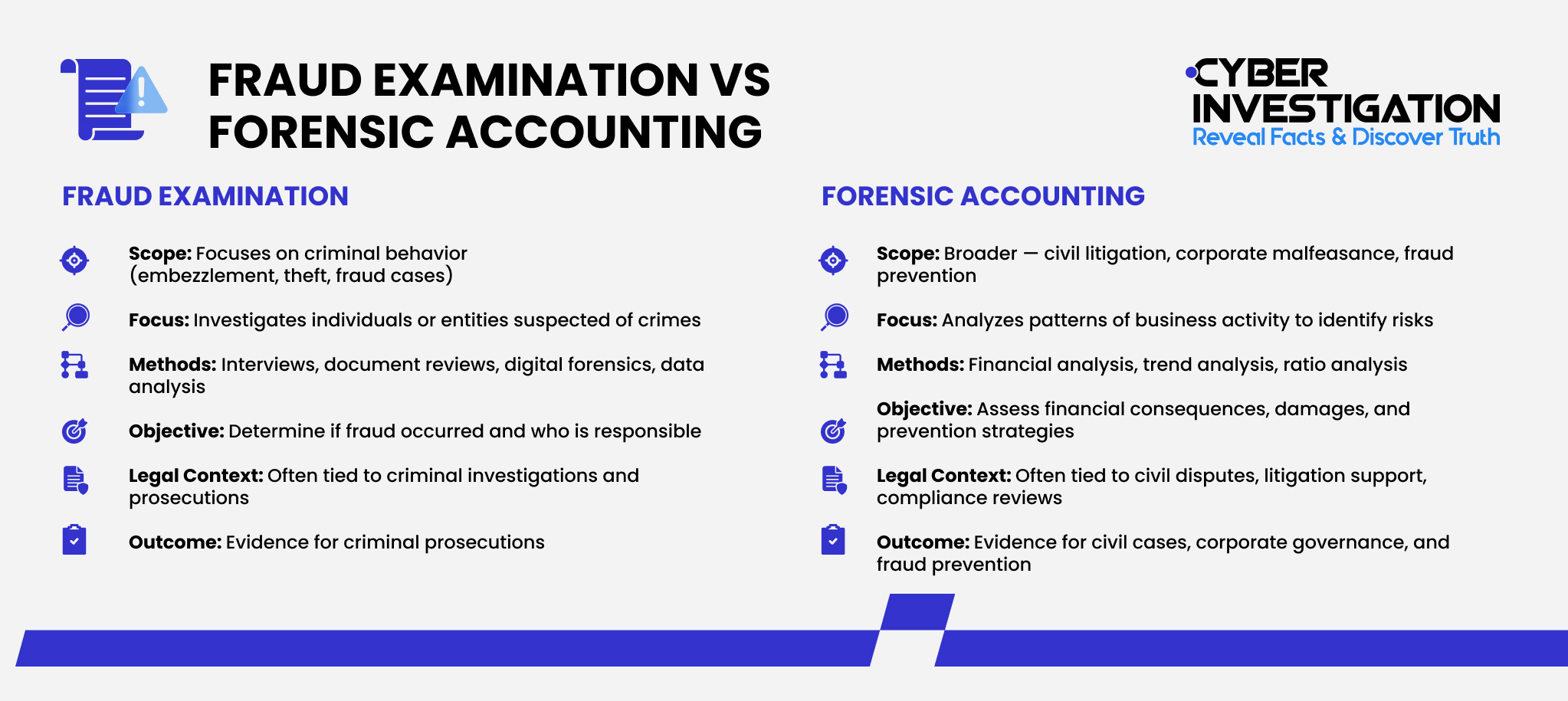

The primary difference between fraud examination and forensic accounting is their scope. The first focuses primarily on criminal behavior such as embezzlement and theft, while the second encompasses a broader range of activities including analyzing financial assets for civil cases and fraud prevention.

In other words, fraud examination looks at specific people or entities who may have committed a crime. While forensic accountant consultant looks at larger patterns of business activity to identify potential areas of risk or wrongdoing.

In addition to their different scopes, fraud examination, and forensic accounting also employ different strategies when it comes to gathering evidence. Fraud examiners use investigative techniques such as interviews, document reviews, digital forensics, and data analysis to uncover evidence of criminal activity.

On the other hand, forensic accountants typically use financial analysis methods such as trend analysis and ratio analysis to uncover evidence related to civil litigation or corporate malfeasance.

Conclusions

Fraud examination and forensic accounting are both important tools for investigating financial irregularities in businesses. While there are similarities between the two disciplines — such as their focus on gathering evidence — there are also some key differences between fraud examination and forensic accounting in terms of scope and methodology.

Understanding the differences between these two disciplines can help you make an informed decision about the type of investigator best suits your needs. By utilizing either a fraud examiner or a forensic accountant, you will be able to ensure that your business remains compliant with applicable laws and regulations while minimizing any potential losses due to fraudulent activity or mismanagement.